Application Form

Please fill out the form below, so we can contact you as soon as possible!

Owner-operators play a pivotal role in keeping the wheels of commerce turning. However, amidst the hustle and bustle of the open road, these independent drivers must navigate the complex terrain of tax obligations. Understanding and managing taxes efficiently ensures compliance and can significantly impact the financial health of an owner-operator’s business.

This article will delve into the essential tax tips designed specifically for owner-operators. From maximizing deductions to staying ahead of regulatory changes, this article aims to empower independent truckers to take control of their financial destiny. By the end of this read, you’ll be equipped with valuable insights on how to streamline your tax processes, minimize liabilities, and avoid paying for unnecessary expenses. Let’s embark on this journey together, arming you with the knowledge needed to steer through the tax landscape and secure a more prosperous future for your business.

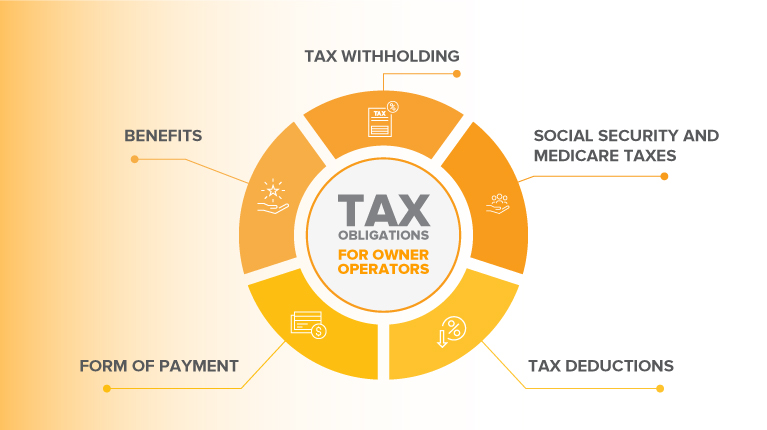

As owner-operators are self-employed and business owners, the taxation can significantly differ from if they were a company driver (an employee). Owner-operators must be aware of the tax distinctions between independent contractors and employees since they affect their financial obligations, available deductions, and overall tax liabilities. To guarantee compliance with tax regulations and to maximize one’s tax situation depending on one’s job status, it is advisable to seek the advice of a tax specialist.

Here’s what you, as an owner-operator, should know:

In addition to the above things, here are essential tax forms and documents required for filing: Schedule C (Profit or Loss from Business), 1099-MISC or 1099-NEC, Form 1099-K (Payment Card and Third-Party Network Transactions), receipts and invoices, mileage log, Form 2290 (Heavy Highway Vehicle Use Tax Return), IFTA (International Fuel Tax Agreement) records, vehicle-related documents, ELD (Electronic Logging Device) records, 1040 Form (U.S. Individual Income Tax Return), estimated tax payments records. Some of these documents aren’t directly tax-related; however, they may be helpful for inspections in the future.

Certain costs are known as deductible expenses that individuals and businesses can deduct from their overall income to lower the amount of revenue that is liable to taxes. By reducing taxable income, these deductions help reduce the amount of taxes owed. The precise deductible expenses may differ according to the tax rules and policies of a given state or area. It’s crucial to remember that tax regulations are intricate and dynamic. A number of variables, including filing status, income level, and changes to the tax code, can affect the availability and magnitude of deductions.

As an owner-operator, you can have the following deductible expenses: fuel costs, maintenance and repair, truck lease or loan payments, insurance premiums, permits and licenses, tolls and scale tickets, depreciation, meals and lodging, education and training, parking fees.

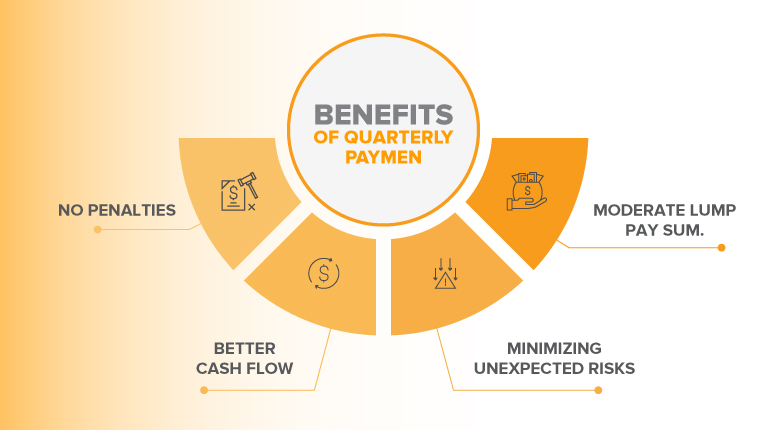

You don’t need to be a rocket scientist to understand that timely tax payments are necessary and beneficial for your business. The best decision for an owner-operator is to make these payments quarterly as it is easier to manage and profitable.

Any business owner wants more benefits for their business, and this is how quarterly payments benefit owner-operators:

And if you want to know how to calculate the quarter tax payment, here are the steps you need to do:

As a taxpayer, you want the IRS to be your friend. And as a business owner, you want it even more. Inconsistent income reporting, high deductions relative to income, unusual financial fluctuations, large charitable contributions, and claiming home office deductions are common triggers. To steer clear, maintain accurate and consistent income records, document legitimate deductions thoroughly, review financials for unusual fluctuations regularly, follow IRS guidelines for charitable contributions, and ensure strict adherence to home office deduction criteria.

If it happens and you fail to fill your taxes on time, filing an extension before the due date is a strategic move. Paying estimated taxes quarterly minimizes penalties and interest on underpayments. Communicating promptly with the IRS, correcting errors swiftly, setting up payment plans for tax liabilities, staying informed about tax deadlines and regulations, and seeking guidance from a tax professional are crucial steps. Timely, accurate record-keeping and compliance with tax regulations significantly reduce the risk of penalties and ensure a smoother tax filing process.

Hiring a tax specialist is essential for owner-operators dealing with complicated financial conditions or adjusting to tax law changes. A tax professional’s experience helps maximize deductions, guarantee compliance, and reduce liabilities if the business has numerous revenue sources, complex deductions, or diverse investments. Additionally, the advice of a tax professional can offer insightful advice and assist in reducing risks during key life events like launching a business, acquiring large assets, or handling audits. Their ability to negotiate complex tax circumstances, in-depth knowledge of tax regulations, and dedication to remaining up to date on regulatory changes enable them to maximize financial outcomes for owner-operators.

Tax software can be useful for owner-operators looking for easy-to-use, reasonably-priced solutions. It simplifies the process of preparing taxes by leading users through credits, paperwork, and deductions. Well-known software solutions, such as QuickBooks Self-Employed or TurboTax, are designed to meet the unique requirements of independent contractors, including proprietors. Even while tax software works well in simple tax scenarios, people with complicated financial portfolios or elaborate business structures could find combining software with expert counsel helpful. A comprehensive approach to tax administration for owner-operators is ensured by striking a balance between employing tax software for mundane activities and engaging a tax professional for strategic planning.

Timely tax payments are paramount for owner-operators to avoid penalties, maintain financial stability, and ensure compliance with tax regulations. Given the nuanced nature of tax obligations, owner-operators are encouraged to seek the expertise of a tax professional for personalized advice. A tax professional can provide tailored guidance, optimize deductions, and navigate complex tax scenarios, contributing to financial success and peace of mind.

Application Form

Please fill out the form below, so we can contact you as soon as possible!